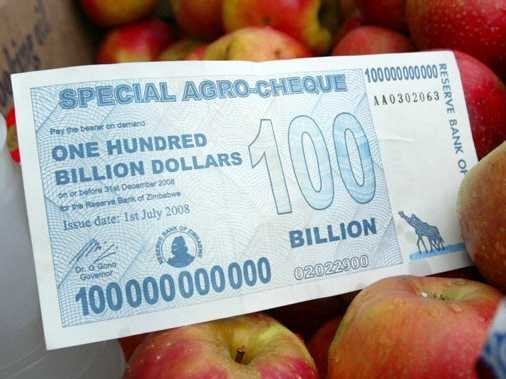

REUTERS / Philimon Bulawayo

A crisp 100 billion Zimbabwean dollar

The best sentence I read today was this one:

“It has been four years and it has yet to be discredited as a viable alternative to fiat currency.”

That’s from Tyler Winklevoss (yes, that one), referring to Bitcoin (naturally), in a NYT story which reveals that the famous Winkelvoss twins own about 1% of the total Bitcoins that are out there.

The crazy price swings of the digital “currency” — which has an ultimately finite supply and is distributed via cryptology, with no Central Bank-like issuer — has prompted numerous discussions about whether the currency could become an important economic entity that’s actually a “viable alternative” to, say, the U.S. dollar. There’s also a lot of discussion about whether the currency is in a bubble, though in a way that’s a less interesting debate.

The real interesting question is whether Bitcoin could become a real thing with an important economic function.

It’s not just the Winkelvosses who think it can.

Last month, well-known VC Chris Dixon said that Bitcoin represented the 3rd great era of currency (first gold, then fiat, then math-based).

Here’s the problem: Fiat currency has intrinsic value. Bitcoin doesn’t.

There’s a popular meme going around that fiat currencies (like the dollar, the British pound, the euro, and the yen) have no intrinsic value, and that they’re only accepted because they’re accepted, and that at some point, people will see through the “illusion” of the value of paper money, and realize that wealth lies somewhere else. Usually this argument is made by gold bugs.

But fiat currencies have tremendous intrinsic value because governments say they do. That’s why they’re called fiat currencies. They have value by government fiat.

This truth might be annoying, but the fact of the matter is that we live in a world of laws, where governments have armies, and can imprison you if you don’t pay taxes. And every transaction that you do is taxed in some way, meaning that to operate in any practical matter in this world means transacting in U.S. dollars.

So the U.S. dollar isn’t just important because other people think it is. The U.S. dollar is important, because the world’s strongest entity, with the full force of the U.S. army, the FBI, the CIA, the NSA, and various local authorities with guns demands that you pay them in U.S. dollars. That’s not faith. That’s the law. Sorry.

Even outside of the requirement to pay taxes in U.S. dollars, the Federal Reserve system has established the dollar as the unit of currency for banking in the United States. So if you want to be plugged into the banking system at all — which is a requirement for virtually all individuals — you have to use U.S. dollars.

So instantly, anyone who says the U.S. dollar is backed by “faith” or an “illusion” has no concept of the sheer force behind the currency.

This isn’t true of Bitcoins at all.

It’s true that there’s a scarcity to them — there’s only a finite amount and there’s a limit to how many there will ever be — but scarcity alone does not give something lasting value.

After all, I could create JoeCoins, and say that I will only issue 100. But it’s unlikely that anybody would give me even a penny for one. And I can’t force anyone to use them, because I don’t have my own army or police force or my own set of laws.

Nobody in the Bitcoin world has the power to compel usage and unlike, say, a commodity, a Bitcoin provides no beauty or functional use outside of that of a trading vehicle.

This Bitcoin, unlike fiat currency (which is backed by the force of law) or commodity-based monies (which have some intrinsic value via use or beauty) is only of value because someone else will accept it, or pay more for it than what you bought it for.

Meanwhile, any hope that merchants would be willing to regularly transact in Bitcoin is blown apart by the recent volatility, which makes it tremendously risky to engage in anything other than ultra-short-term transactions. You’d certainly never have someone perform a service priced in Bitcoin lasting any length of time, since you’d have no idea whether you were paying the person $20,000, $100,000 or $1 million.

In light of these obvious problems, a strain of counter argument has emerged that the intrinsic value of Bitcoin lies in its role as a technology that’s disruptive to the payments space.

Timothy Lee writes in Forbes:

As I write this, the value of all outstanding Bitcoins is a bit less than $3 billion. Is that a big number or a small number? It’s a difficult question because the answer depends on what happens to the underlying Bitcoin economy in the coming years. The value of Bitcoin-denominated transactions has been rising steadily. If that process continues, the “Bitcoin economy” could be much larger in five or ten years than it is today.

To give just one example, Western Union has a market capitalization of $8.5 billion and earned $1.3 billion in profit in 2010. If you think Bitcoin will eventually become a popular way to transmit money internationally, it’s not crazy to think Bitcoin’s “market cap” will be in the same ballpark as Western Union’s.

Obviously, that’s just a rough back-of-the-envelope estimate. Maybe Bitcoins won’t pose a competitive threat to Western Union. But the point is that at the scale of global financial networks, $3 billion is a pretty small amount of money. If Bitcoin proves superior to conventional financial networks for at least one significant application, it’s easy to imagine enough demand for the currency to justify the current valuation.

Felix Salmon, in his widely-read piece on Bitcoin kind of said the same thing:

… bitcoin is in many ways the best and cleanest payments mechanism the world has ever seen. So if we’re ever going to create something better, we’re going to have to learn from what bitcoin does right – as well as what it does wrong.

Jerry Britto says something similar:

The answer is that bitcoin doesn’t need to be a good unit of account or a good store of value to be a good medium of exchange. Indeed, the prices of products and services being sold for bitcoin online today are denominated in dollars and are converted at the market rate for bitcoin when the transaction happens. This is how WordPress, one of the most prominent companies accepting bitcoin, does it. In fact, WordPress never even handles bitcoin. They employ the services of a very interesting company called Bitpay that manages bitcoin payment processing for them.

When you check out at WordPress using bitcoin, Bitpay quotes you the total of your dollar-denominated shopping cart in bitcoin at the current exchange rate, takes your bitcoin payment, and then deposits dollars in WordPress’s account. This allows WordPress to sell to persons in Iran or Haiti or anyone of the dozens of other countries where PayPal, Visa and MasterCard are not available. It also highlights bitcoin’s true disruptive quality as a payments system—one that is unstoppable, largely anonymous, and incredibly cheap to boot.

It’s possible that in fact Bitcoin has created the most efficient, disruptive payment system ever.

But here’s the thing, and this addresses Tim Lee’s point above: If this is the only value, then all the world needs is one Bitcoin, since a digital currency should be divisible into an infinite number of “Bitcents” or whatever you want to call them. If we’re just talking about a technological idea to transport money and communicate, then why do you need to create new ones? You don’t. And if for some reason, people really want to make payment with this level of secrecy and cryptology (and admittedly, there’s obviously a demand for private, untraceable money) then you can just create a Bitcoin clone or competitor (which already exist).

So Bitcoin has no intrinsic worth from a currency perspective (no army, no functional use, no law backing it) and its role as a disruptive medium of payment is something that needn’t involve scarcity, and is susceptible to cloning.

We should also take a moment to praise what an amazing invention fiat currency as we know it is.

People love to talk about how the Fed is debasing the dollar, but that’s total nonsense.

We’ve lived through extraordinary economic times in recent years, with monetary policy acrobatics that are virtually unprecedented. And a dollar will more or less buy you the same amount of “real stuff” (beer, rent, gas, etc.) that it did before all this. Yes, there’s slow inflation over time, but that’s mostly matched by increases in salaries, so it doesn’t make a big deal.

Even Europe, which is currently an economic and monetary disaster of historic proportions, has a currency that’s stunningly stable and liquid. Think about that. Despite the horrible policy in the Eurozone, the Euro is still a fine currency to do business in.

Heck, you know those pictures of Weimar Germany?

Dialog International

As awful as the hyperinflation was, people were still using the currency (at least to some extent) because they had to.

So paper currency backed by government is amazingly stable, useful, and even in terrible times, still gets used. Bitcoin, sadly, has none of that going for it.

It’s a fascinating real-time economics lesson. The bubble mentality is just mesmerizing. If you remember the Yahoo Finance Message Boards back during the dotcom bubble, then the Bitcoin page on Reddit will seem very familiar. But little digital tokens backed by nothing but a hope that you can sell them to a greater fool tomorrow are not the future of currency, and have no intrinsic value.

SEE ALSO:

What is Bitcoin?

Article source: SAI http://feedproxy.google.com/~r/typepad/alleyinsider/silicon_alley_insider/~3/1Xj5dZWurNM/bitcoins-have-no-value-2013-4