The mobile health marketplace is flourishing like a weed these days. According to mHealthWatch and eHealth Initiative, there are 31,000 health and medical-related apps on a marketplace today. In fact, over a final year, a series of health apps jumped 120 percent, and hundreds of apps now strike stores any month. Yet, in annoy of this exponential growth, a mobile health space is still in a “Wild West” phase. In other words, it’s a work in progress.

As mHealthWatch points out, there’s a lot of sound in a mobile health market, and a lot of dubious information. So, while a intensity is high, there’s not adequate information nonetheless to infer that these products act as advertised and indeed yield genuine value.

Simplee, a startup that has been called a Mint.com for medical expenses, wants to sire a trend of over-promising and under-delivering in today’s mobile health market. Simplee initial launched a medical wallet behind in 2011 to assistance people improved conduct their medical financials — to lane visits, guard advantages and compensate bills online, for example.

Considering how costly medical can be, and what a pain in a donkey it is to manage, people are fervent to find any approach to streamline a routine and revoke costs — to their reason and their wallet. By creation this interest to consumers, Simplee has been means to find some traction: Today, it processes millions of dollars in payments any month opposite “thousands of medical providers” and has managed $2 billion in medical bills given launch.

Earlier this year, a startup stretched a service, bringing a B2B-style remuneration and faithfulness height to hospitals to concede them to discharge digital bills, among other things. The thought being to offer hospitals a medical wallet that can, on a one hand, assistance them boost revenues, while creation it easier to broach new facilities and a improved billing knowledge for patients on a other.

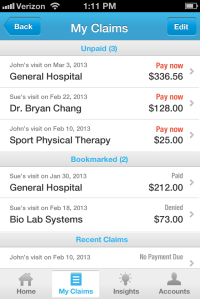

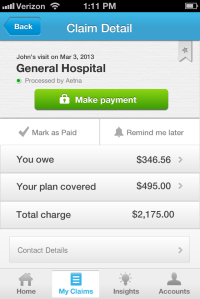

Last week, a startup took a subsequent step in a evolution, fluctuating a medical wallet to a indicate of use by a new mobile app that allows people to conduct and compensate all their family’s medical bills from their phone, while on a go. In so doing, Simplee’s prophesy has been to transition from simply being a Mint.com of medical to a arrange of Mint.com-meets-PayPal, for healthcare, expanding a medical wallet and ordering it with SimpleePAY.

The new app allows users to perspective their medical story while in a doctor’s bureau or go behind by billing story to see either they’ve met their deductible, for example. They can also perspective a relapse of word coverage and compensate by credit, withdraw or FSA card.

The new app allows users to perspective their medical story while in a doctor’s bureau or go behind by billing story to see either they’ve met their deductible, for example. They can also perspective a relapse of word coverage and compensate by credit, withdraw or FSA card.

Again, that’s all good and good, though when we cruise a above fact — that many mobile health apps make large claims about preference and a ability to urge users’ health in a poignant approach — it doesn’t meant most though ancillary evidence. So, we asked Simplee to share a small bit some-more about how consumers are profitable medical bills online and either or not they’ve indeed been means to boost remuneration opening among users, for instance.

While it’s still too early to contend for mobile, as Simplee only launched a mobile app final week, a founders tell us that Simplee’s online medical wallet has been means to furnish an boost in self-service payments of 17 percent, that has doubled in a final 6 months. Compared that to 1 to 3 percent — what a association says is a attention norm. They also design mobile to play a vicious purpose in pushing self-service even higher, generally during a point-of-service (i.e. during a doctor’s office).

In addition, a association says that 90 percent of a users creation mixed payments after creation their first, and that 40 percent of a payments come from users who have upgraded to a full medical wallet experience, that means that they get an stretched billing perspective with deductible status, some-more stored remuneration methods and so on.

In other words, a founders trust that this is a proof of a fact that users cite plane payments and that a consumer side of a business is feeding a B2B-side of a remuneration platform. The initial step was to build an online medical wallet, a subsequent was to build a connected provider remuneration platform, and a third has been to bond a dual and offer both practice around mobile during a point-of-service.

In other words, a founders trust that this is a proof of a fact that users cite plane payments and that a consumer side of a business is feeding a B2B-side of a remuneration platform. The initial step was to build an online medical wallet, a subsequent was to build a connected provider remuneration platform, and a third has been to bond a dual and offer both practice around mobile during a point-of-service.

In a sense, it’s not most opposite from what Pageonce is attempting to do on a some-more ubiquitous consumer-side of a mobile check remuneration space. Simplee is holding that and requesting it to healthcare, while attempting to yield a value-add for hospitals and medical providers.

It’s too early to tell either or not Simplee can significantly enhance a business by a new mobile experience, but, given that it’s already determined some validation online, a founders have high hopes for mobile. It’s a intelligent play, and could have a large outcome on a approach people compensate their medical bills, shortening a headache and complex, paper-based billing routine that continues to overcome in healthcare.

- SIMPLEE

Simplee® is transforming out-of-pocket payments into a clear, convenient, and devoted experience. Our business are innovative health caring providers focused on a studious as a rising consumer.

Simplee processes millions in payments opposite thousands of providers. Both providers and their patients benefit:

Patients accept a delightfully transparent check they can know and trust

Providers get faster studious payments, some-more self-service, and other capability gains

Simplee®PAY is the studious payments and faithfulness height that offers transparent interactive bills, stretchable remuneration options, and exclusive technology…

→ Learn more

Article source: http://feedproxy.google.com/~r/Techcrunch/~3/6bwCthlspaA/