Michael Jurgen Garbade

Michael Jurgen Garbade is an entrepreneur-in-residence at a burgeoning international startup.

See Also:

What Is A Super-Injunction, And Why Does A UK Football Star Want To Sue Twitter?

Jean-Claude Juncker Admits It’s His Job To Protect, Not Tell The Truth

Instagram Has 4.25 Million Users Just 7 Months After Launching

This information is based on an empirical study that dealt with differences in VC financing of US, UK, French and German IT startups.

There are relatively few large global IT companies in Europe. A widening gap is observable in the success rate of VC backed startups between the US and Europe in the IT sector.

This gap could be attributable to the differences in the VC financing of IT startups in the US, UK, Germany and France. The comparison is conducted on the venture capital firm level.

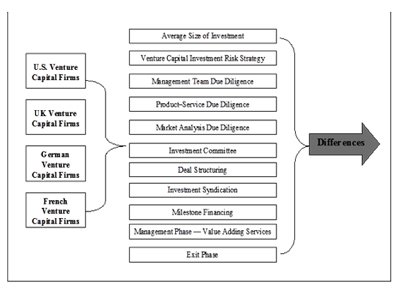

The differences are analyzed for the whole VC investment cycle: contact phase, initial screening phase, due diligence phase, deal structuring and negotiation phase, management phase, value adding services and exit phase. The study that gathered the following information looked at the following differences in the VC investment cycle:

Average size of investment in the seed stage, average size of investment in the start-up stage, average size of investment in the growth stage; percentage of startups in pre-revenue phase at time of investment; percentage of startups not managed by founders but experienced managers; percentage of investment in startups with me-too products; percentage of market analysis due diligence done informal; typical liquidation preference multiple; percentage syndicated exits that are outperformers; number of tranches per investment round; number of board seats per partner and the cash multiple X that defines an outperformer.

The empirical data was based on a 15-minute online questionnaire with 119 VCs in the US (69), UK (16), Germany (19) and France (15). The online questionnaire was preceded by 24 face-to-face preliminary expert interviews with VCs in Silicon Valley (6), London (3), Paris (6), Hamburg (3), Munich (5) and Berlin (1). The key findings of the study are:

1. On average, 64 percent of startups in which US VCs invest in already received angel investment, compared to 38 percent for UK VCs, 34 percent for French VCs and 28 percent for German VCs.

2. It was not proven that the average size of investment in the seed stage in the US is bigger than in Germany, the UK or France.

3. It was proven that the average size of investment in the startup stage in the UK is bigger than in Germany.

4. It was proved that average size of investment in the growth stage in the UK is bigger than in Germany.

5. US VCs reserve more money to avoid dilution in follow-on rounds in the seed, startup and growth stage than UK, German and French VCs.

6. It was proven that median percent of startups in pre-revenue phase at time of investment in the US is bigger than in Germany, the UK or France.

7. US VCs pursue the following portfolio model: (percent outperform, perform, survive or die): 16%: 25%: 19%: 40%; UK VCs 15%: 24%: 21%: 39%. German VCs: 21%: 29%: 18%: 32%; French VCs: 17%: 35%: 20%: 33%. US and UK VCs pursue a similar portfolio model, while German and French VCs also pursue a similar portfolio model. US and UK VCs pursue a more aggressive portfolio model than French and German VCs.

8. It was proven that median percent of startups not managed by founders but experienced managers (CEOs) in the US is bigger than in Germany, the UK or France.

9. The way investment decisions are structured in US investment committees is more democratic than in UK, German and French investment committees.

10. It was proven that median percent of investment in startups with me-to products in the US is smaller than in Germany, the UK or France.

11. US and UK VCs first conduct market due diligence, then management team due diligence followed by product due diligence whereas German and French VCs first conduct product due diligence, then management due diligence, followed by market due diligence.

12. It was proven that median percentage of market analysis due diligence done informally in the US is bigger than in Germany.

13. In the evaluation of the product-service of a startup, German and French VCs are more keen on IP protections than US and UK VCs.

14. French and German VCs put more emphasis on the experience and management team’s domain expertise than US VCs.

15. It was proven that median liquidation preference multiple (LPM) in term sheets in the US is less than in Germany, the UK or France.

16. The intensity of syndication between German VC syndicate partners is lower than in the US, UK and France. Unlike US and UK VC firms, German and French VC syndicates are more open to a new syndicate partner if the syndicate partner has the financial resources.

17. It was proven that median number of tranches per investment round in the US is less than in Germany.

18. It was not proven that U.S. VCs provide startups with more strategic and operational support in the investment management phase than French, UK or German VCs.

19. US VCs speak more frequently with senior managers (non C-level executives) than UK, German and French VCs. UK VCs speak more frequently with senior managers than German and French VCs.

20. It was proven that the median cash multiple X that defines an outperformer exit in the U.S. is bigger than in Germany.

21. US and UK VCs have more meetings per year with corporate development teams from big corporations than German and French VCs.

22. UK, French and German VCs keep startups in their portfolios longer than U.S. VCs.

Article source: SAI http://feedproxy.google.com/~r/typepad/alleyinsider/silicon_alley_insider/~3/8KyMcGbTh50/differences-in-venture-capital-financing-of-us-uk-german-and-french-information-technology-startups-2011-5