The purpose of the dongle-to-debit system is to simplify the lives of small and medium business owners. It is hard for businesses that operate on the streets outside of their localized shops to keep revenue from being lumped in with all incoming and outgoing funds. Imagine the farmers’ market where a farmer uses GoPayment (or Square etc.) and the funds go straight to a business or regular account. Intuit wants to make that process simpler.

“Specifically there were things we noticed from a customer perspective among some smaller businesses is that there was a problem with comingling of funds,” said Christopher Battles, head of product management of Intuit’s payment solutions division. “Combine that with the fact that you have seen CitiBank raising some rates and things that are happening as a result.”

The debit card is a minor announcement in the larger mobile payments world, but it signifies a shift that financial institutions are readily providing tools to make electronics payments more popular. As we learned last week, 85% of transactions are still made with cash. Intuit, like Mastercard, wants to see electronic and mobile payments take up a bigger slice of the pie.

“Cards have been eating into cash-based payments for a long period of time in the same way that you are going to see electronic-based payments eat into cards over time,” Battles said. “My perspective is that they are going to coexist for a long period of time but cards are going to be with us for a while.

Robert Scoble Checks Out GoPayment

Yet, as we have noted before, NFC is not going to take over tomorrow. The financial institutions and management companies can create all infrastructure they want in terms of wallets, offers, and NFC receptor terminals, it will not make a difference until consumer behavior changes. A good portion of that will be the inflection point when NFC-enabled smartphones become ubiquitous, which will not be for several years at the least.

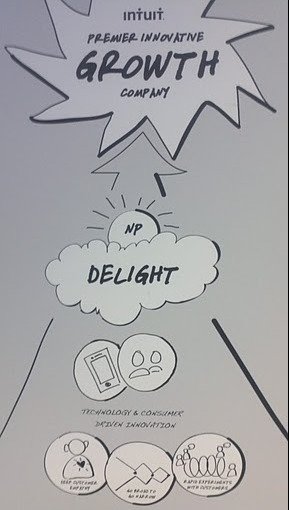

Yet, dongles will continue to rise and there is room for everyone. Square is the thought leader, but it can be argued that Intuit, with QuickBooks, tax refunds, bank partnerships, health check-ins and other management systems already in place, is in better shape to handle mobile payments going forward.

“So, to serve your customer and the people who provide your payments, you are going to be have to be able to do that,” Battles said. “NFC and some of these other payments will offer certain benefits … To some measure, until it is quicker and easier than going to your wallet and swiping a card, it is going to be a while.”

When we look at the mobile payments ecosystem, there is a lot to like. From Mastercard’s QkR innovations to Intuit’s management capabilities, payments are on the way to changing the fundamental nature of how consumers transfer money from one point to another.

Article source: RRW http://feedproxy.google.com/~r/readwriteweb/~3/sdb8qlRymGY/intuit_showcases_mobile_payments_innovation_introd.php