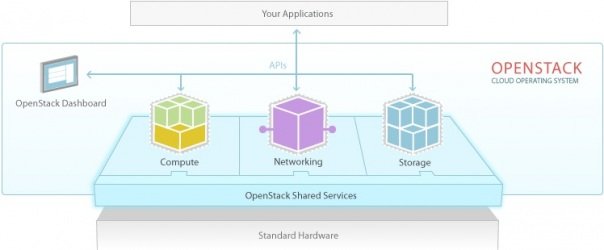

It has already been a busy year for OpenStack, the open source cloud operating system created by NASA and Rackspace. Service providers are trickling in with OpenStack support, just as startups and established software vendors are racing to release their OpenStack distributions. There are more than 190 companies signed up as community members of OpenStack.

For corporate strategists that are figuring out how to align their portfolios in the nascent OpenStack market, the key question is whether there’ll be a dominant distribution when everything settles down. In other words, will the OpenStack distribution market be fragmented with no vendor having more than 10 percent of the install base, or will there be a handful of dominant vendors that control a key cloud infrastructure layer?

Let’s now look at what companies, in their various sectors, are best positioned to develop the dominant distribution.

Hardware vendors

Hardware vendors care about OpenStack because they ultimately have to optimize their gear for the software that runs on it. When hardware is a commodity in cloud-scale deployments, there is little more differentiation standard hardware, such as x86-based servers, can provide.

To address this, hardware vendors will continue to develop IP to support their hardware stack and become the preferred hardware platform for OpenStack. Dell (see author bio below), an early entrant in the OpenStack scene, for instance, has open sourced its Crowbar installer package to install OpenStack on its hardware. This helps vendors become arms dealer to both large service providers and private cloud customers.

Software vendors

Software vendors fall into two groups: application vendors and software platform vendors. Application vendors have it easy in making sure their apps are “certified” to run on the cloud platform. It’s a win-win for both the application vendor and the cloud OS distributor to drive their combined go-to-market strategies. Since their applications are already certified at the VM layer and the VMs are guests on the cloud OS, the impact to application vendors is minimal.

The software platform vendors will be more challenged. Those that have proprietary platforms will have to compete aggressively to prevent customer migration to open platforms (e.g., Microsoft to OpenStack). Those that have open platforms will have to invest to move OpenStack to parity state or better than proprietary platforms. There are many new startups (e.g., Piston Cloud, Nebula, StackOps) that are competing with the established open platform vendors (e.g., Red Hat, SUSE, Canonical) in this space, and this is probably where the most interesting software innovation will happen.

The wild cards are the current closed-platform software vendors that have no prior open-source street cred, but have nevertheless joined OpenStack (for reasons best known to themselves!). These firms will have challenges communicating a shift in their strategy both internally and externally. Are they abandoning their proprietary operating systems and platforms? What would their future portfolio mix look like? Are they really open source champions or just opportunists?

Beyond communication, their strategy execution is also fraught with risks, such as whether their new OpenStack support will cannibalize their current install base. Vendors like VMware that have a proprietary cloud computing operating system (vCloud, in VMware’s case) will have to draw a fine balance on how their homegrown products will co-exist with OpenStack.

Service providers

Service providers, a majority of which are traditional hosting companies or IT outsourcing firms, now have the opportunity to deploy a software layer that turns previous-generation virtualization already running in their datacenters into a cloud. This is exciting because it means a better customer experience thanks to cloud computing capabilities, as well as a better provider experience thanks to benefits such as improved hardware utilization. Service providers have three options when moving to the cloud:

- Build their own cloud operating system/orchestration layer.

- Use a single software platform vendor’s cloud operating system.

- Use multiple software platform vendors.

Option 1 is tough unless you have a certain type of DNA in the organization or acquire a software platform vendor. Option 2 means betting your future on one provider, which can expose you to some risks. Option 3 is too operationally complex to manage, despite the choices provided to customers. Additionally, options 2 and 3 in the case of OpenStack simply mean switching out higher-cost VMware or Microsoft software to a potentially lower-cost open source alternative (we do not know the full cost of ownership yet, hence I qualify this as “potentially lower cost”).

Rackspace’s global footprint

The wild card in this category is clearly Rackspace. Unlike other service providers, it is a founder of OpenStack and the largest contributor of source code to the project. Add its customer service-focused differentiation and service provider roots, and it gets very interesting to see how Rackspace is redefining its own corporate growth.

However, there’s also a third type of service provider — pure play professional services firms that build and deploy OpenStack clouds. Firms such as Mirantis have developed unique IP around their tools and process to accelerate the rollouts of OpenStack clouds. It will be interesting to see the larger impact these firms will have in driving the direction of the project.

Who will be the winners?

Predicting winners is often difficult when the scenarios are dynamic. There are three distinct possibilities in the OpenStack scenario:

- The open-source cloud leader board could go the same way as the Linux leader board, where true open source firms can execute in the future, too.

- A leader in one category above partners or acquires a leader from another category, therefore extending its reach into each other’s categories and getting the distribution and adoption acceleration to establish significant first-mover advantage.

- An upstart races to the finish line with strategic partnerships and stronger execution than legacy vendors.

One thing to consider is that it matters how many of the OpenStack supporters actually make contributions back to the core OpenStack source code to drive innovation and mass adoption. This contributor list from April 2012 shows only a dozen of then 186 companies making significant contributions to the trunk.

Also important to winning in the OpenStack space will be understanding the nuance of selling to different customers, which will have different buying preferences depending on their size. Large firms might want their applications to run on the same OpenStack distribution between private and public clouds, and expect the same level of support on each, whereas small firms that prefer public-cloud deployments may or may not care about which OpenStack distribution their apps run on. For private-cloud buyers looking for a workload-optimized software-plus-hardware cloud, it remains to be seen whether an OpenStack distribution suited for public clouds will serve these specialized environments.

One thing is for sure, though: he who writes code owns his destiny. The profits and margins are high in software and services, and when OpenStack gets deployed in a datacenter — private or public — there’s revenue and profit to be made supporting the deployment for whoever provides the code. But that support will not be a trivial effort when the platform is still in its early stages, so firms that have strong engineering talent to hack OpenStack will be the ones that make the most of the situation now.

Prabhakar Gopalan is the cloud computing domain leader in corporate strategy at Dell. Opinions expressed here do not reflect those of his employers. You can follow Prabhakar on Twitter: @PGopalan. Prabhakar is also the founder of Simple Idea Labs, and kanban2go.com is one of their first experiments. Prabhakar writes and talks about products, strategy and chaos.

Feature image courtesy of Shutterstock user Brian P Gielczyk.

Article source: GigOM http://feedproxy.google.com/~r/OmMalik/~3/mSv1WvW23as/